Current Market Data

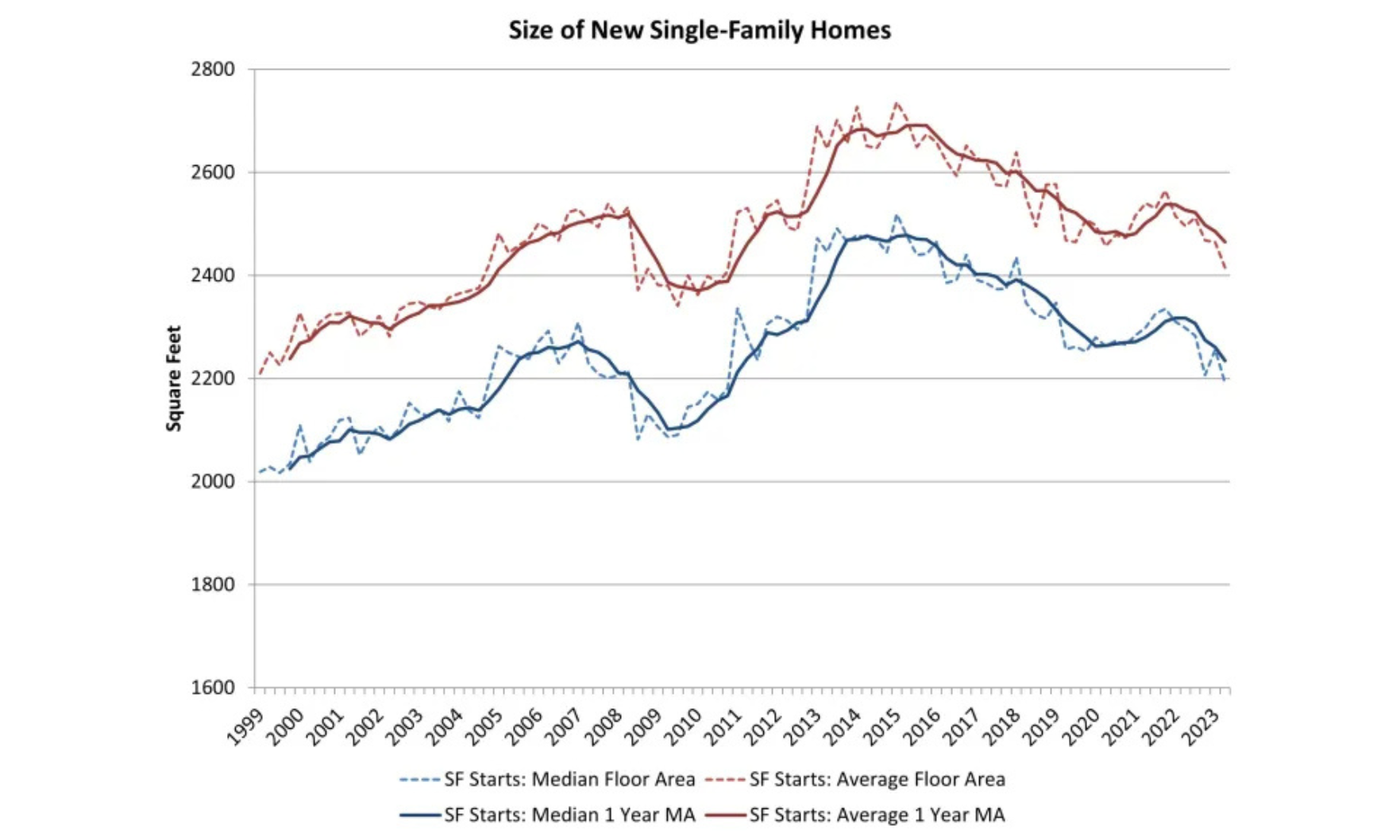

The median area for a new single-family home fell to 2,191 square feet in the second quarter — the lowest recorded size since 2010.

CoreLogic expects prices to continue to grow through next year, albeit at a more traditional pace than in the height of the pandemic.

Those looking to buy a house will be paying a premium as inventory continues to be an issue.

Eighteen percent of millennials — approximately one in five — believe they will never become a homeowner, according to a recent survey from Redfin.

BrokeScholar examined population growth in 150 U.S. “college towns” — defined as cities with at least one major public or private university.

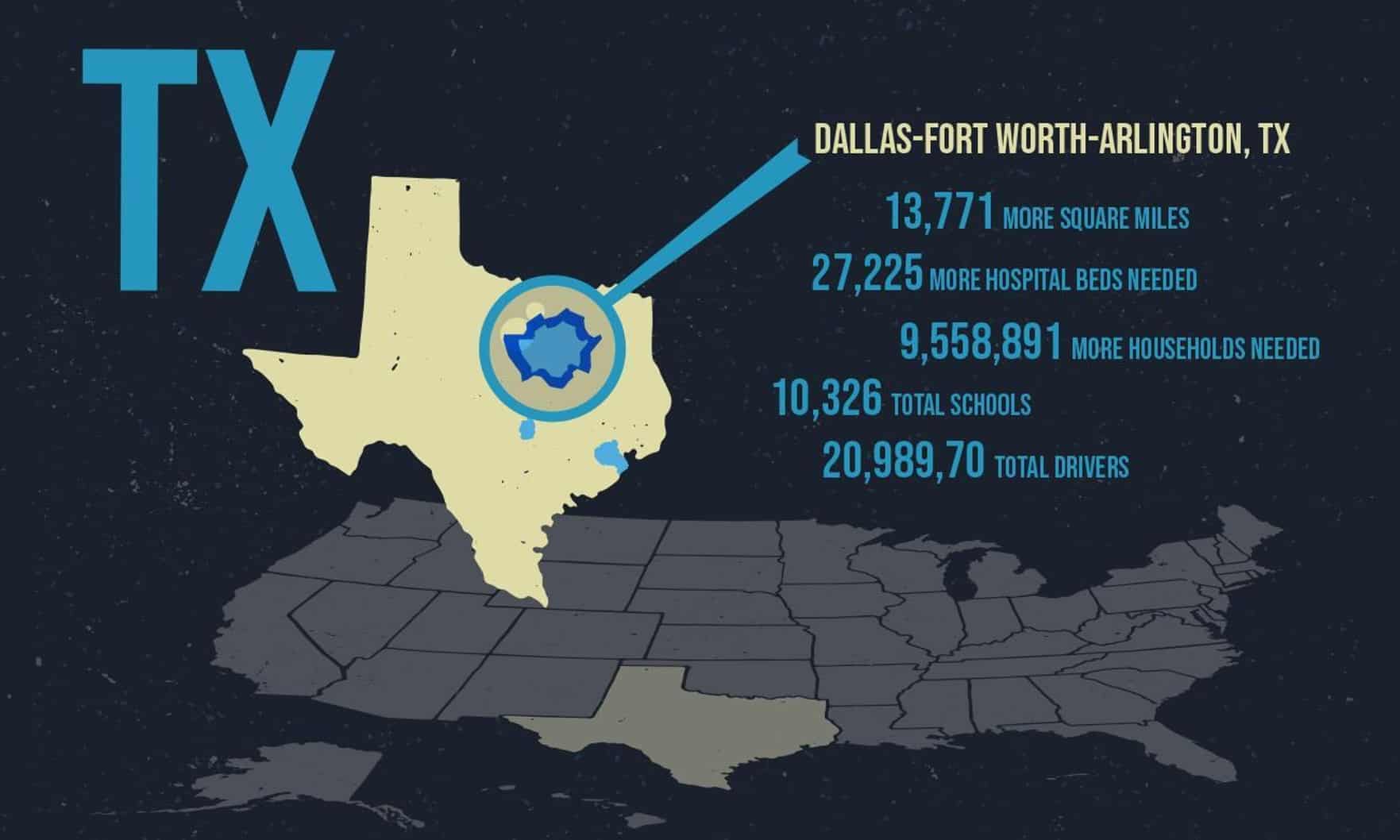

Luxury homes in the Dallas-Fort Worth area make up a majority of the priciest new listings from the past month.

Pending transactions were in negative territory for most of this year, so the recent increases could bode well for future activity.

A fifth consecutive month of increases in the S&P CoreLogic Case-Shiller U.S. National Home Price Index suggests the housing market recovery that began earlier this year is likely to continue.

Two weeks after housing inventory turned negative, home prices posted a healthy increase, MarketNsight said.

First-timers made up 45% of buyers in 2022 and 37% in 2021.

High mortgage rates and limited inventory continued to weigh on sales activity, National Association of REALTORS®Chief Economist Lawrence Yun said.

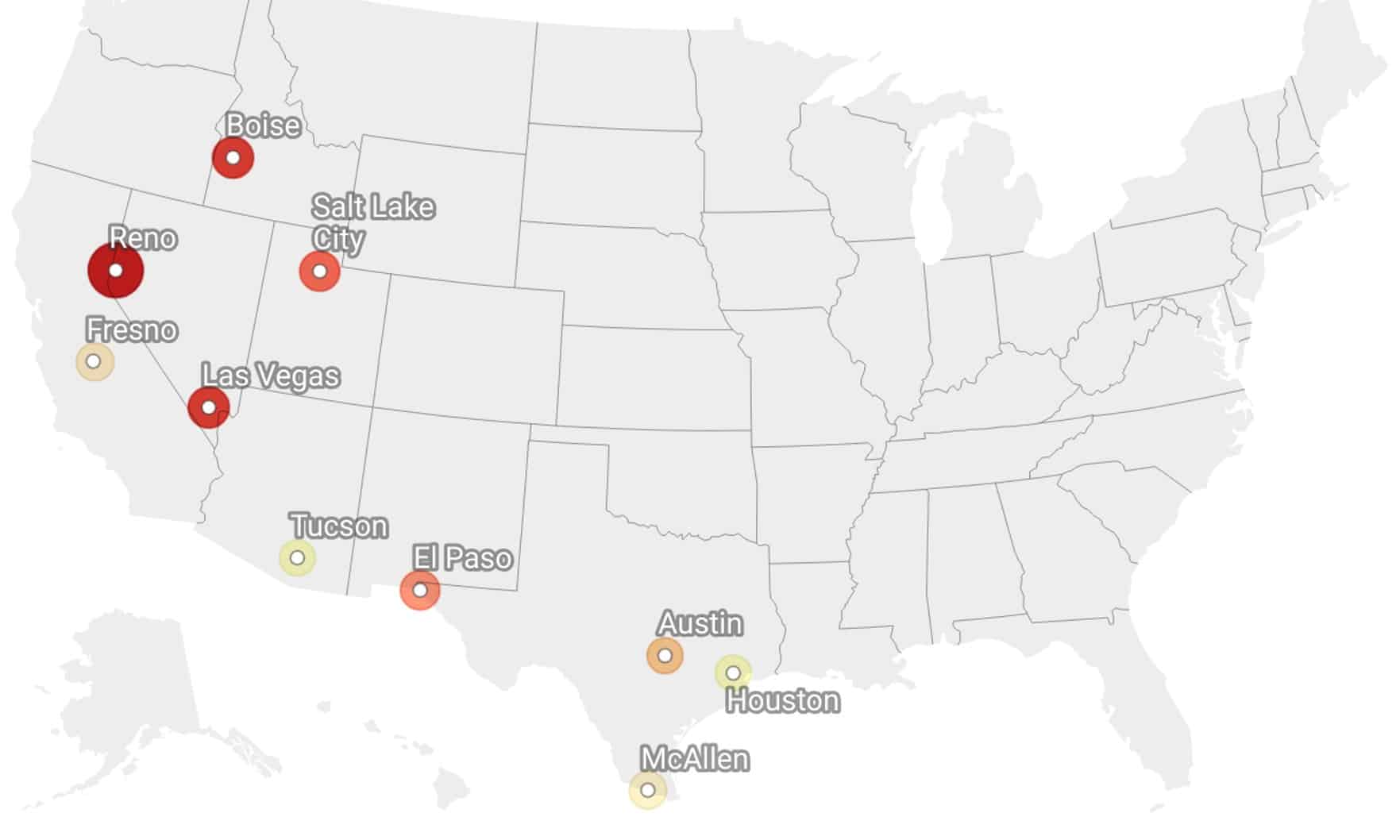

A new report from moveBuddha shows that the typical buyer isn’t yet factoring in climate-related risks when deciding where to live.

Single-family home permits and completions, meanwhile, also rose, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Experts predict that Dallas will be one of the most populated places in America by 2100. But can the metro actually handle all that growth?

Meanwhile, July’s home sale prices had their highest increase since November.

Over 100,000 Californians made the move to Texas in 2021 — that translates to roughly 300 new Texans on a daily basis.