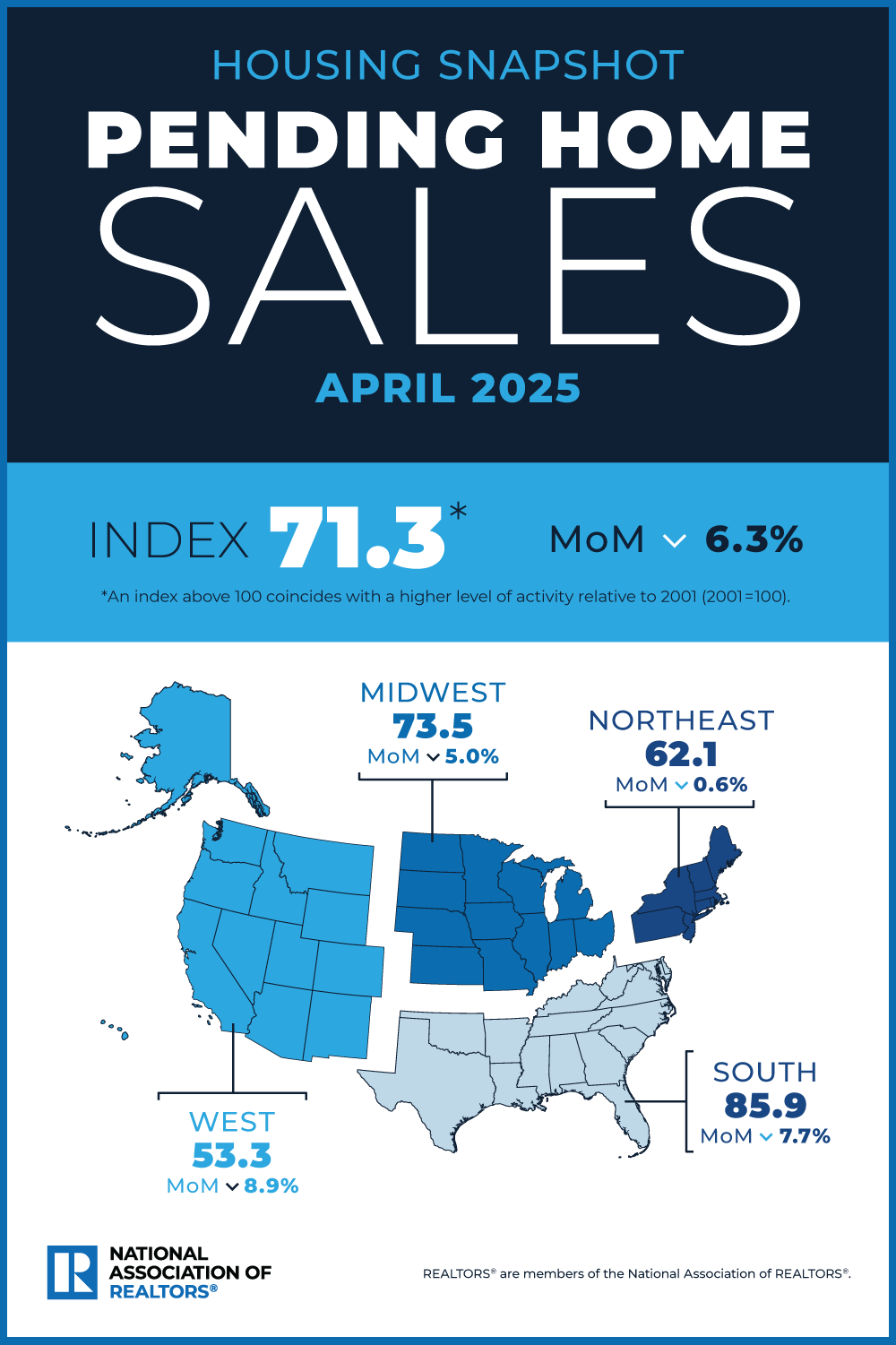

Pending home sales plunged 6.3% in April, well below the 0.4% decline economists were expecting, as high mortgage rates blunted any boost that higher inventory could have delivered.

All four regions experienced month-over-month declines, led by the West, where pending transactions slid 8.9%, the National Association of REALTORS® (NAR) said, citing its Pending Home Sales Index.

Year over year, pending sales were down 2.5%.

“At this critical stage of the housing market, it is all about mortgage rates,” NAR Chief Economist Lawrence Yun said. “Despite an increase in housing inventory, we are not seeing higher home sales. Lower mortgage rates are essential to bring home buyers back into the housing market.”

Pending sales — where a contract has been signed but the transaction hasn’t yet closed — are considered a leading indicator and generally precede existing-home sales by a month or two.

First American Deputy Chief Economist Odeta Kushi called April’s results a “nosedive” and noted the drop is the steepest month-over-month decline since September 2022.

“The pending home sales data continues to point to a frozen housing market, with transaction activity bouncing along the bottom,” Kushi said. “Elevated mortgage rates and economic uncertainty are headwinds for the housing market. However, rising inventory, which puts downward pressure on prices and allows incomes to catch up, serves as a tailwind.”