Current Market Data

The NAR’s Community Aid and Real Estate (CARE) Report shows that REALTOR® associations donated a median of $12,070 this past year, a 20% increase over 2020.

New-home construction posted a 12.2% month-over-month increase in August, thanks in large part to a significant jump in multifamily building.

A continuing combination of increased interest rates, supply-chain disruptions and high home prices has sapped homebuilder sentiment every month this year.

The housing market is starting to become more balanced.

Mortgage applications declined 1.2% during the week ended Sept. 9, according to the Mortgage Bankers Association’s Weekly Mortgage Applications Survey.

Modern homes are still the most popular interior design style, according to a new study from Confused.com, a financial services comparison website based in the U.K.

Mortgage applications, pending sales, new listings and overall inventory saw large declines in August.

Homebuyers nationwide had more time to make decisions in August with the first year-over-year increase in median days on the market since June 2020.

Buyers who are still in the game are finally getting a break from bidding wars

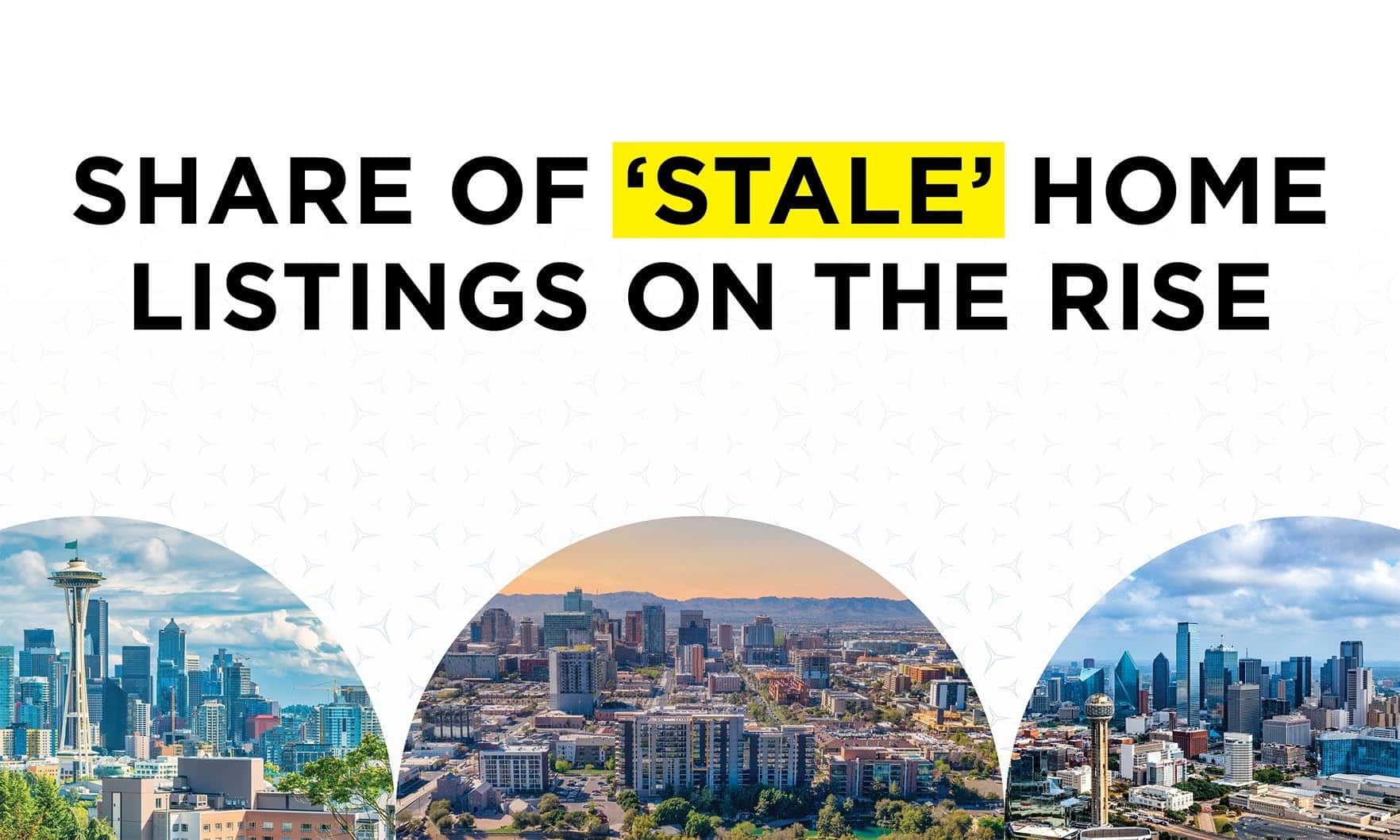

The share of homes listed for more than 30 days has increased 42.9% in Dallas and 43.4% in Fort Worth in the last year, according to Redfin.

The modest 1% decline could indicate the current housing cycle is reaching a bottom as mortgage rates recede from their recent high, the National Association of REALTORS® said.

The median price of a new home sold during the month was up 5.9%, however, according to figures from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

Nationally, the median sales price slid 2.9% from June but rose 8.1% from July 2021, while closed transactions were down 16.6% on a monthly basis and 26.3% on a yearly one, RE/MAX said in its National Housing Report.

A recent decline in mortgage rates could return some purchasing power to buyers going forward, National Association of REALTORS® chief economist Lawrence Yun said.

The pace of housing starts for both single-family and multifamily residences was down on a month over month basis, the U.S. Department of Housing and Urban Development reported.

The NAHB/Wells Fargo Housing Market Index fell for the eighth straight month in August, as the key measure of builder confidence indicated a pessimistic outlook.