Current Market Data

Despite a slow start to the spring homebuying season, prospective buyers are showing some resiliency in the face of higher mortgage rates, as seen by two weeks in a row of increasing loan applications.

Homes are selling at record-breaking speed.

Seventy percent of the 185 metros surveyed by the National Association of REALTORS® saw double-digit price gains in the first quarter, compared to 66% in the preceding period.

Overall mortgage-application volume was at its lowest level since 2018, the Mortgage Bankers Association said.

Low inventory and rising interest rates have reduced prospective homebuyer purchasing power.

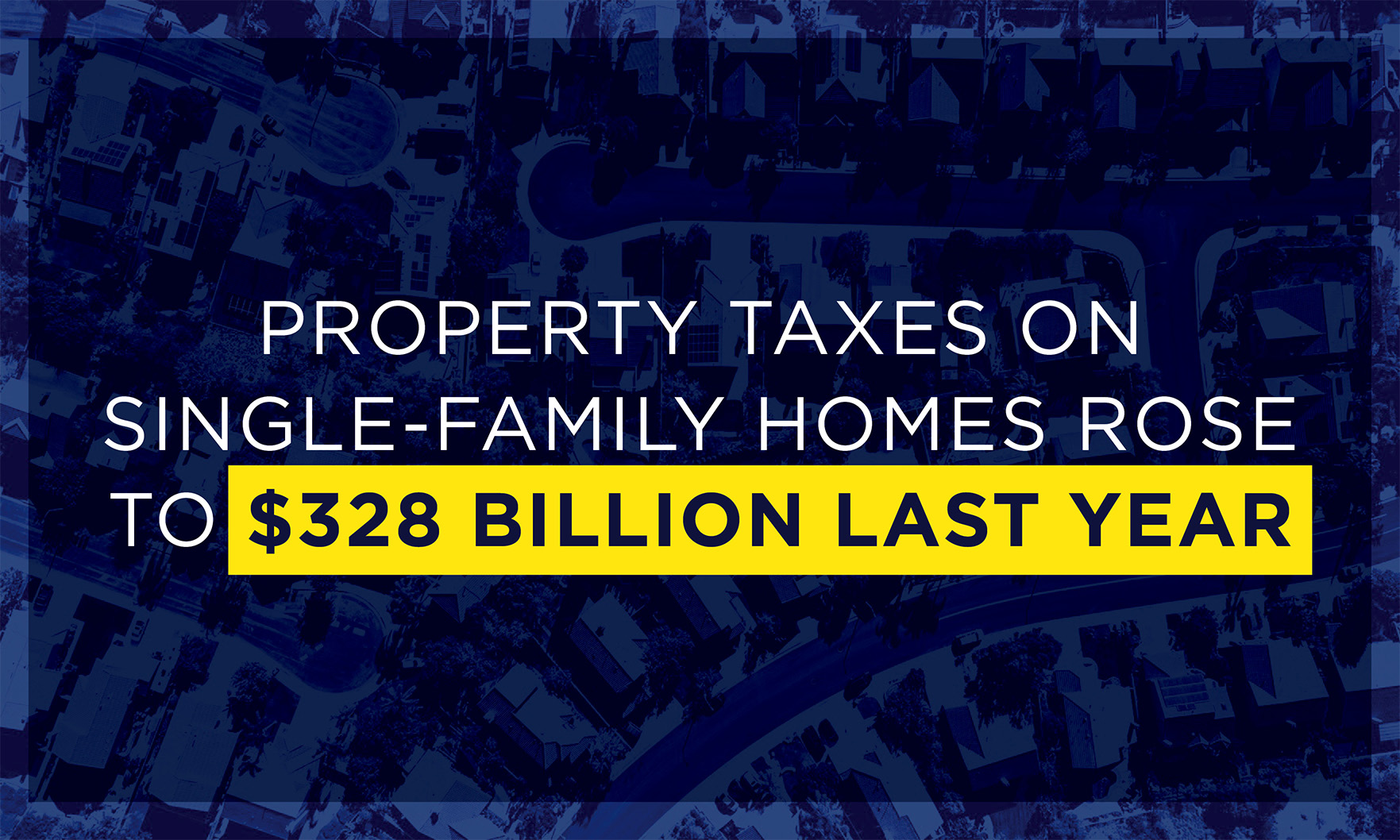

Property taxes across the U.S rose last year, but the hike was much lower than in 2020, according to a new report. ATTOM found in its 2021 property tax analysis of almost 87 million single-family homes, $328 billion in

Rising interest rates and home prices have taken a toll on would-be homebuyers’ purchasing power, leading to increased inventory and another monthly slowdown in sales.

Single-family home starts declined compared to February, while new apartment construction was up, according to government statistics.

Builder sentiment has taken a hit from an unexpectedly sharp increase in mortgage rates and continued disruptions in the supply chain, according to the National Association of Home Builders’ monthly survey.

Investor activity showed early signs of slowing during Q4 of 2021, down from the historic highs seen in the second and third quarter, CoreLogic’s latest analysis reveals.

Report finds buyers are backing off from buying second homes, but what’s causing the turnaround?

Surging mortgage prices deterring more buyers

With fewer people putting their homes on the market, prices continue to skyrocket.

The decrease comes as interest rates continue to climb, according to the Mortgage Bankers Association.

“Buyer demand is still intense, but it’s as simple as ‘one cannot buy what is not for sale.” — National Association of REALTORS® chief economist Lawrence Yun

Housing inventory should reach pre-pandemic levels by the end of 2024, according to the results of Zillow’s latest Home Price Expectations Survey. More than 100 market experts and economists weighed in to predict upcoming trends.