Trends

For data-driven stories, to appear under “Trends” menu

The supply of new homes for sale ticked lower from February, according to government figures.

The annual rate of 4.58 million sales was up 14.5% from January but down 22.6% from the February 2022 rate of 5.92 million.

Nationally, the week of April 16-22 is likely to provide sellers with the most favorable conditions for a successful sale of any week of the year, although the exact timing varies widely by market.

A shortage of existing-home inventory is driving more people to the market for newly built homes.

Increased mortgage rates have sidelined many would-be buyers, allowing inventory levels to increase. As a result, buyers can now “shop around” more than during the peak of the pandemic, putting the burden of concessions back on sellers.

Homebuilders expressed “cautious optimism” that the lack of existing inventory would drive demand for new homes despite high construction costs and interest rates, the National Association of Home Builders reported.

There are 58 less million-dollar cities in the U.S. than there were in July of last year, according to a new report from Zillow.

The Texas housing market may have finally calmed from the pandemic housing frenzy, according to the Texas REALTORS®’ 2022 Texas Real Estate Year in Review report.

The Mortgage Bankers Association noted the increase in borrowing activity came despite the 30-year fixed mortgage rate climbing to its highest level since November 2022.

In January, home prices were up 5.5% annually and down 0.2% monthly, CoreLogic reported, citing its monthly Home Price Insights report.

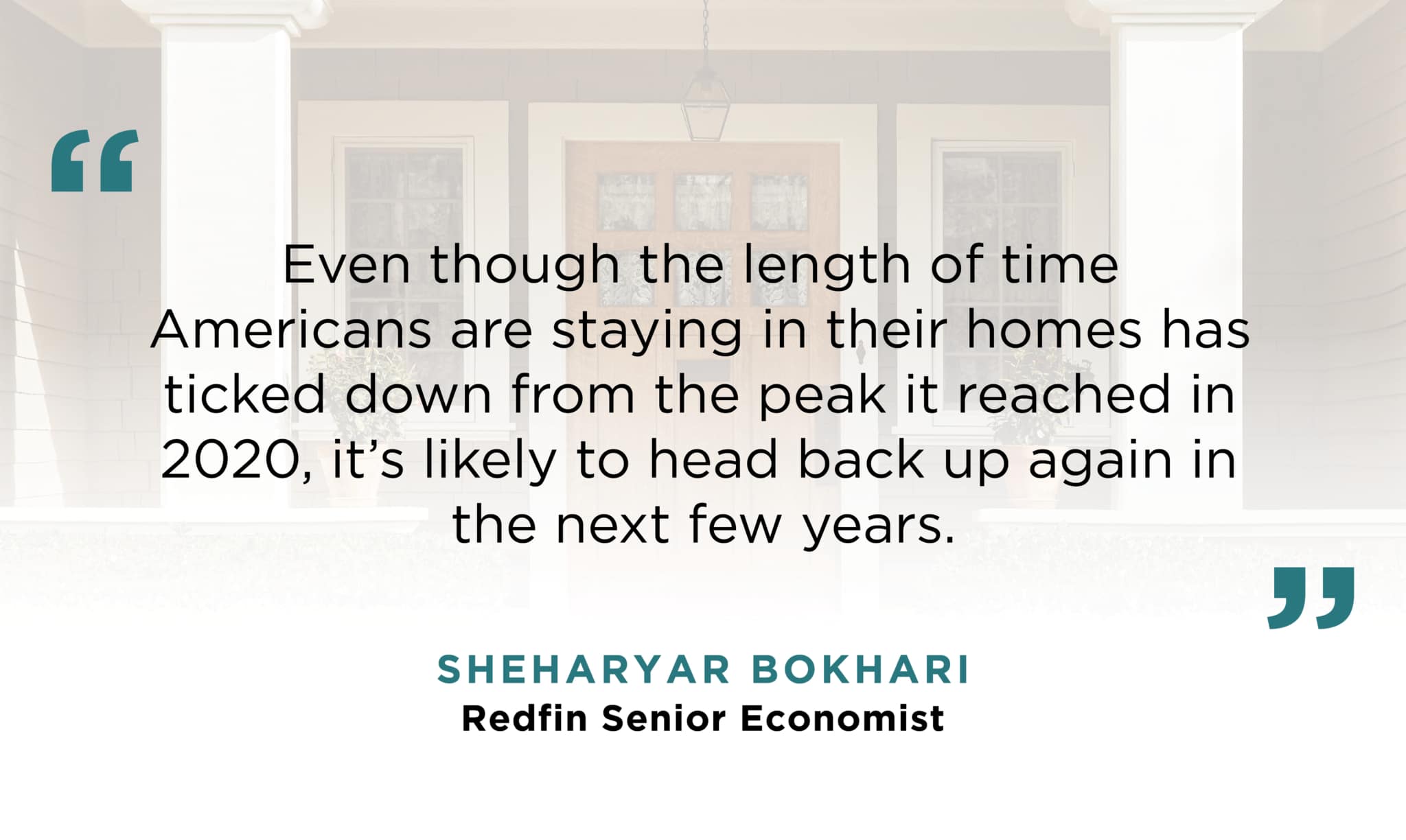

People staying in their homes longer is contributing to the lack of inventory that continues to impact buyers.

The S&P CoreLogic Case-Shiller U.S. National Home Price Index rose 5.8% year-over-year in December, compared to a 7.6% gain in November.

Dallas is one of the most popular places to move to — or, at least the most popular places to think about moving to, according to a new analysis from Redfin.

The 8.1% month-over-month increase in the National Association of REALTORS® Pending Home Sales Index was the largest gain since June 2020.

The median sales price of a new home declined on both a monthly and yearly basis, however, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development reported.

Curious about luxury inventory in Texas? These homes are the most expensive new listings currently for sale in the Lone Star State.