Sales of newly constructed single-family homes surged unexpectedly in August, blowing past economist expectations and hitting their highest level since January 2022 as homebuilders pulled out the stops to move inventory.

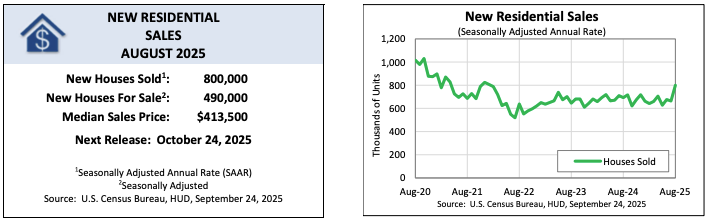

The seasonally adjusted pace of new-home sales jumped 20.5% from July’s upwardly revised annual rate of 664,000 homes to 800,000, according to the Commerce Department. The increase, which represented a 15.4% gain from August 2024, blew past the consensus estimate of 653,000.

“Lower mortgage rates, along with builder incentives and discounts, helped unlock demand in August,” First American Deputy Chief Economist Odeta Kushi said, noting that 39% of builders cut prices in September, the highest level since COVID. “Demand is there, but it’s taking incentives to coax hesitant buyers off the sidelines. Whether this momentum can be sustained remains to be seen.”

At the same time, the supply of new homes for sale plunged 17.8% from nine months in July and 9.8% from 8.2 months in August 2024 to 7.4 months at the current sales pace.

The median sales price of new homes sold in August was $413,500, up 4.7% from $395,100 in July and 1.9% above August 2024.

Regionally, new-home sales ballooned 72.2% month over month in the Northeast and rose by more modest amounts in the South (24.7%), Midwest (12.7%) and West (5.6%).

In Dallas-Fort Worth, new-home sales rose 3.9% year over year, while the median-sale price of a newly built home slipped 4.8% to $379,990, and inventory surged 18.5% to 9,050 active listings, REMAX DFW Associates agent Todd Luong noted.

“This pricing shift suggests builders are adjusting to meet buyers’ affordability needs, even as inventory continues to climb,” Luong said. “The close-to-original-list-price ratio also dipped to 93.8%, indicating increased room for negotiation for new-home buyers. Prices are trending downward, giving buyers a bit more breathing room. With builders sitting on a record pipeline of new homes, the question heading into the fall is whether this recent uptick in sales can hold steady amid high inventory levels and broader economic uncertainty.”