National News

Kenny Parcell has resigned as president of the National Association of REALTORS® following a recent bombshell report by the New York Times into allegations of sexual harassment within the organization.

McKinney ranked as the No. 1 real estate market in the country.

MLS freeze strikes agents in Florida, Massachusetts, Indiana, New York, California and elsewhere.

Single-family home permits and completions, meanwhile, also rose, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development.

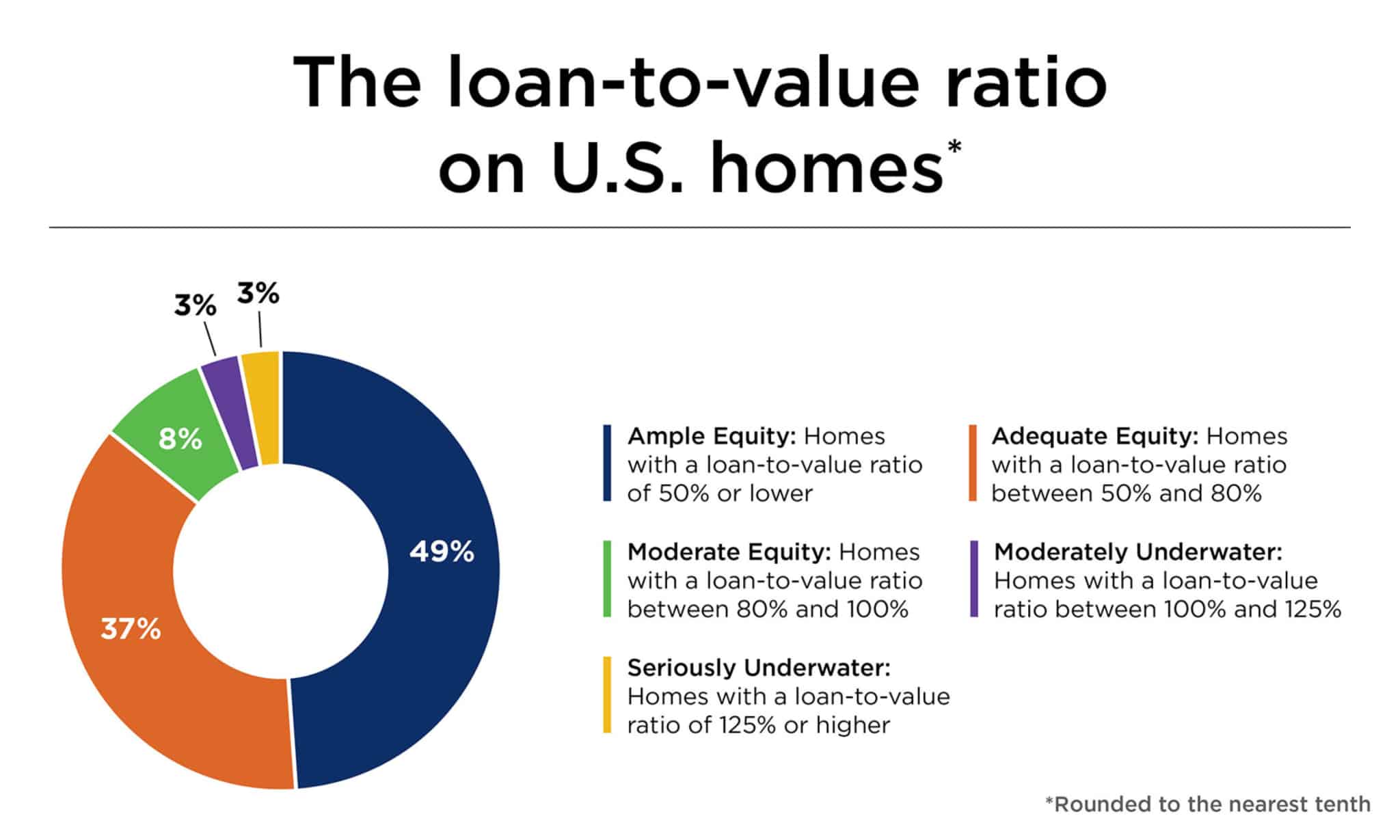

Homes where the loan-to-value ratio is 50% or lower — equity-rich homes — are on the rise, which is good news for homeowners.

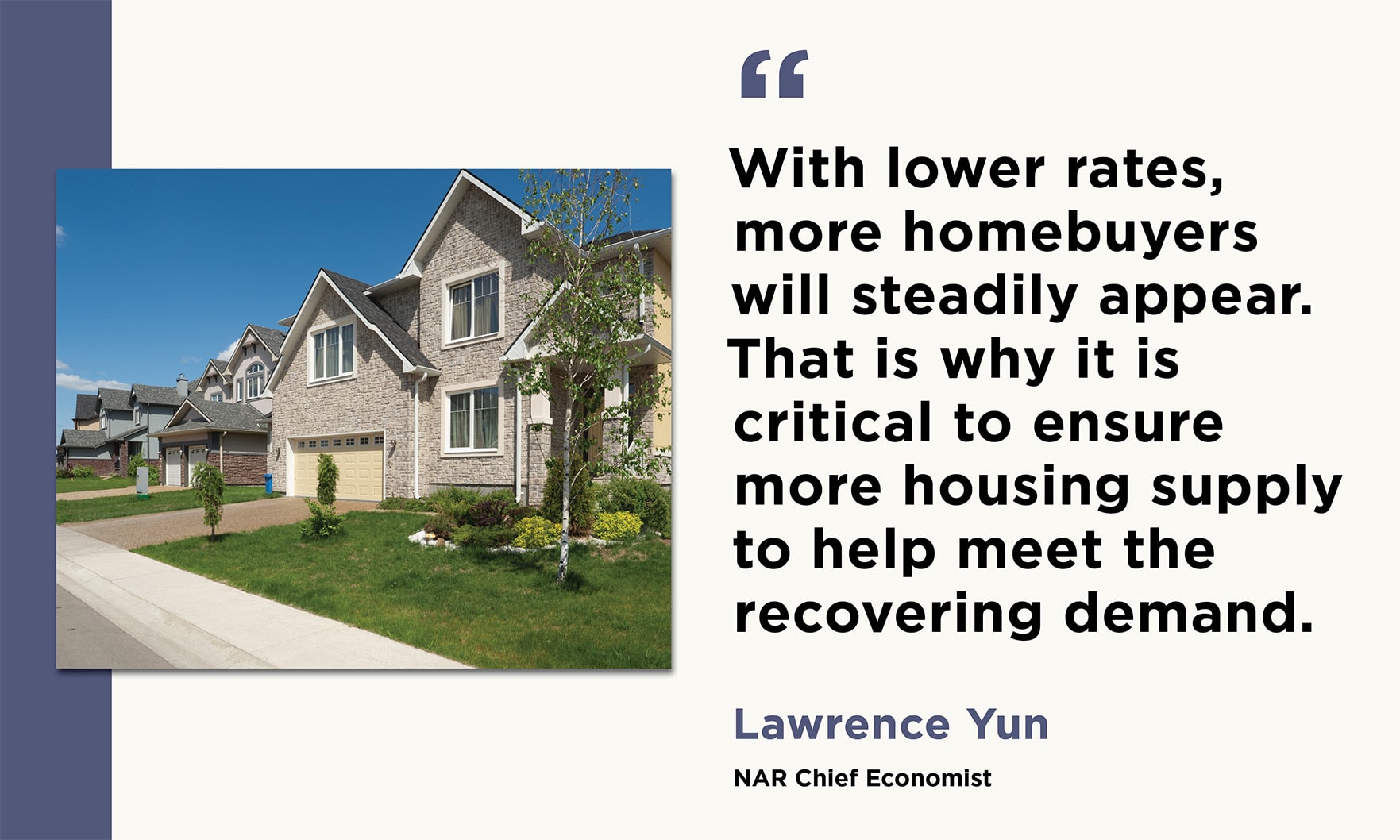

Meanwhile, July’s home sale prices had their highest increase since November.

For the first time in almost 12 months, the average U.S. home is selling above its asking price, as the average sale-to-list price ratio hit 100.1% earlier this month

Set to debut on July 17, “Drive with NAR: The Safety Series” will be hosted by former real estate agent and expert, Tracey Hawkins.

The National Association of REALTORS® has been named in a new lawsuit by Janelle Brevard, the organization’s former chief storyteller. NAR President Kenny Parcell is named multiple times in the complaint.

According to the NAHB, The New American Home® represents the latest in luxury real estate. It was unveiled at their recent tradeshow.

Guaranteed Rate is adding more support systems and training for loan officers to boost its reverse mortgage program.

This was the fourth week in a row of declines, leaving prospective buyers hopeful for sustained low rates throughout spring homebuying season.

“Latinos are more mortgage ready. Latinos have made strides in income and are more educated in the homebuying process,” said Nidia Fromenta Peguero of Century 21 North East in Danvers, Massachusetts. “They don’t want to rent anymore.”

Vice President of Association Affairs Jennifer Wauhob brings over a decade of experience to her new role with NAR.

One major business-friendly perk in Texas is the statewide 0% corporate income tax.

Four out of the top five safest cities in America are in Texas, according to a new report from SmartAsset.